Unveiling the Future of Fintech: Valencia will be the epicenter of the future of fintech

In an unprecedented move, the European fintech sector is set to mark a historic milestone with the celebration of the 100 European Fintech Summit. This forthcoming event shines a spotlight on the maturity and innovation within the sector, distinguishing itself by gathering the largest and most established fintech companies across the European Union. Unlike any previous gathering, this summit promises to be a pivotal moment for business, collaboration, and expansion within the fintech industry.

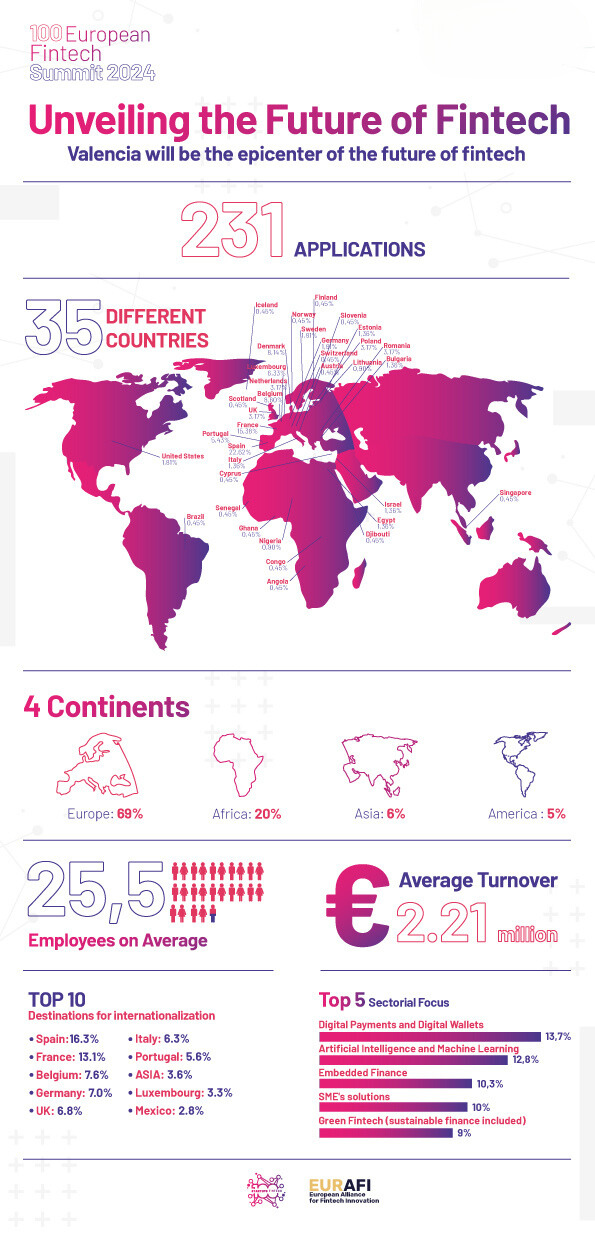

The main expectations of the organizer were to create and ecosystem itself with the most exciting fintech companies in Europe and they got it: 231 applications of large scale companies from 35 countries and awesome numbers of activity and turnover.

A global fintech ecosystem: 35 countries and 4 continents

The 100 European Fintech Summit is not merely a conference; it is a beacon for the industry's future, bringing together mature companies that have transcended the early stages of development. These are firms that have shown substantial growth, resilience, and innovation, characteristics that are vital for the ever-evolving financial technology landscape. With 231 applications from 35 different countries spanning four continents, the summit underscores the global impact and interest in Europe's fintech capabilities. The breakdown of applicants by continent—69% from Europe, 20% from Africa, 6% from Asia, and 3% each from Latin America and North America—highlights the diverse interest in the European fintech scene.

A Summit of scaleups: average of 25 employees and 2.5 turnover.

The financial technology sector is often synonymous with startups, yet the profile of companies participating in this summit tells a different story. These are not fledgling enterprises but scaleups with significant achievements under their belts. On average, companies attending have more than 25.5 employees, with an average turnover of 2.5 million euros. This includes over 50 startups boasting turnovers greater than 2.5 million euros and 20 companies exceeding 7 million euros. Such figures not only emphasize the financial robustness of these firms but also their capacity for sustained growth and innovation.

Scale up friendly with all the key players of the sector

The summit's unique structure facilitates an unprecedented level of networking and collaboration among fintech scalepus, banks, investors, and corporations. This environment is fertile ground for forging joint ventures and strategic partnerships, aimed at bolstering their presence in international markets, notably in America and Asia. By facilitating direct connections among these stakeholders, the summit acts as a catalyst for cross-sector innovation and cooperation.

European is the largest fintech lab in the world.

Highlighting the diversity within the European fintech ecosystem, the top five countries represented at the summit include Spain (22.62%), France (15.38%), Belgium (8.60%), Danmark (8.15%), and Luxembourg (6.33%). This geographical mix underscores the widespread nature of fintech innovation across the continent.

In the same line, banks and Accelerators from 10 european countries has confirmed their presence during the summit, which will allow the attendees to look for international markets with the facilities provided by different partners.

Digital Payments and AI

In terms of sectoral focus, digital payments and wallets lead the charge (13.7%), followed closely by artificial intelligence and machine learning (12.8%), embedded finance (10.3%), solutions for SMEs (10%), and green fintech (9%). Such diversity in specializations illustrates the multifaceted approach European fintechs are taking to revolutionize financial services.

Conclusion

The 100 European Fintech Summit is poised to be more than just an event; it's a turning point for the industry. By bringing together the crème de la crème of the fintech world, the summit not only highlights the sector's current achievements but also paves the way for future collaborations, innovations, and expansions. For banks, investors, and corporations, the summit offers a unique opportunity to connect with these leading companies. For the fintechs themselves, it's a chance to forge alliances that will strengthen their positions on the global stage. As the date approaches, the European fintech sector waits in eager anticipation for what promises to be an unparalleled gathering of minds and talents.